Hello, everyone!

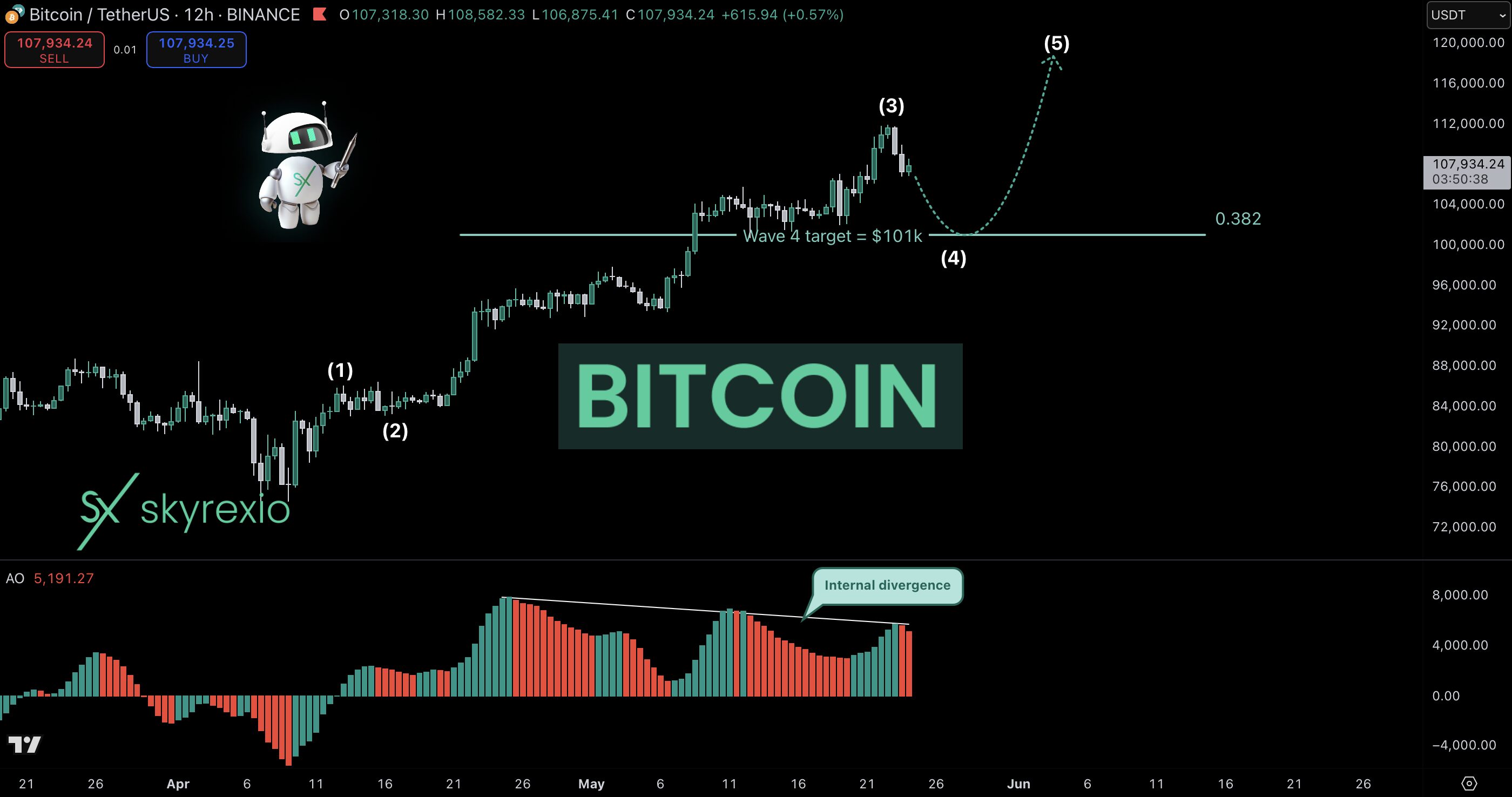

I am still in my long position for the Bitcoin, but today it shows us some potentially dangerous movement. I was ready to close my trade, but did not get the confirmation of the bearish scenario.

As you can see on the chart the BTC broke to the upside the countertrend line and now it is forming some kind of it’s retest. Now it looks like that this retest is successful. Moreover the price shows the reaction from the Fibonacci golden pocket. Next to such strong support levels the Stochastic RSI gave us three powerful long signals: bullish divergence, bullish crossover and all this happened in the oversold area. As a result I expect the local uptrend continuation.

Good luck!