No-Code Crypto Trading Bot: How to Build an Algorithmic Strategy, Backtest It, and Launch via Exchange API

Algorithmic crypto trading sounds complicated until you break it down into what it really is. You define clear rules for entries and exits, you control risk, and you validate the idea with data. In Skyrexio you can do this without programming using the Strategy Builder. It lets you assemble a strategy visually, run a backtest, test it in a safe environment, and then launch your bot through an exchange API.

This article is written to work for two audiences at once. If you are new, it gives you a straightforward path that avoids the most common traps. If you are experienced, it focuses on validation so your backtest is realistic and not just a pretty curve.

What a no-code crypto trading bot really is

A crypto trading bot is an automated system that opens and closes positions based on predefined rules. In a typical DIY setup you write code, connect to an exchange, maintain servers, and debug edge cases. A no-code trading bot removes the engineering overhead. You build the logic in an interface, and the platform handles execution.

That does not remove risk. It removes friction. The edge still comes from having a sensible strategy and strong risk management, not from the fact that it is automated.

How Strategy Builder is structured in practice

Strategy Builder is not an abstract “rule editor”. It follows the same blocks you see in the interface, which makes it easier to reason about how your bot will behave.

You start with Main Settings. This is where you choose the exchange account, the quote currency for the market, your trading amount, the list of coins, and the cap on how many trades can be active at the same time.

Next is the Base Order. This is your primary entry. You set the order type and how your conditions are evaluated. In most indicator-based systems, evaluating on candle close is safer, because signals are less noisy inside a candle.

If your strategy uses scaling in, you enable Additional Entries. This is where you add to a position either based on a price move or based on indicator conditions. It is useful for DCA-style logic or for adding only when the trend is confirmed.

Then comes what exit means in this builder.

Take Profit is your profit-taking exit. You can set it by percentage or by conditions, and you can use partial take profit to close in portions.

Stop Loss is your protective exit. It can also be percentage-based or condition-based. In practice, this is the safeguard you want to have defined from day one.

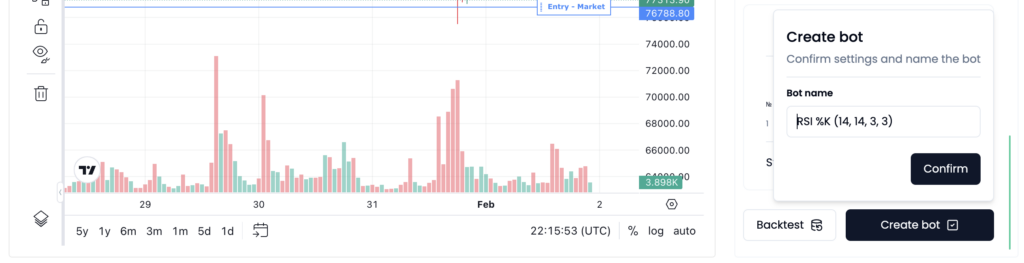

Finally, Create & Name is where you save the bot and give it a clear name.

In short, entry is Base Order plus, if needed, Additional Entries. Exit is Take Profit and Stop Loss.

Before you start: exchange API keys and basic safety

To launch a bot through an exchange API, you need an exchange account connected via API keys. In most cases the bot only needs read access and trading permissions. Withdrawal permissions are usually unnecessary and are best left disabled.

If you are new, start on liquid pairs like BTCUSDT or ETHUSDT. Liquidity matters because it reduces surprises from slippage. Also start small. At the beginning, your goal is not maximum profit. Your goal is a clean process.

A simple safety habit is to cap the number of simultaneous trades. When too many positions run at once, it becomes harder to understand what is working and what is not.

Building a strategy without code: a simple path that works

If you want your first strategy to be understandable and testable, keep the architecture clean.

Pick a timeframe. Many beginners do better with 1h or 4h. Lower timeframes can generate more entries, but they are more sensitive to fees and slippage.

Add a market regime filter. A common and intuitive option is a trend filter using a moving average. For example, only consider longs when price is above an EMA, and only consider shorts when price is below it.

Add one clear entry trigger. RSI is a popular starting point. Crossovers can work too. The key is that the trigger should be unambiguous. When you look at a trade, you should immediately understand why it was opened.

And define your exits early. In real algorithmic trading, exits often matter more than entries. A good entry signal can still lose money if your exits are vague.

Exits and risk management that keep strategies alive

In this builder it is important to use the right mental model. Your exits are defined through Take Profit and Stop Loss. They are explicit closing mechanisms. Take Profit locks in gains, Stop Loss caps losses.

Risk management is broader than a stop. It starts in Main Settings where you control trade size and the number of active trades. It continues with Stop Loss where you define maximum damage per trade. Only after this foundation is solid does it make sense to polish entry logic.

If you are new, keep it simple. One entry, no aggressive scaling in, one take profit, one stop loss. Once you have enough live-like data, you can explore partial take profit or condition-based protective exits.

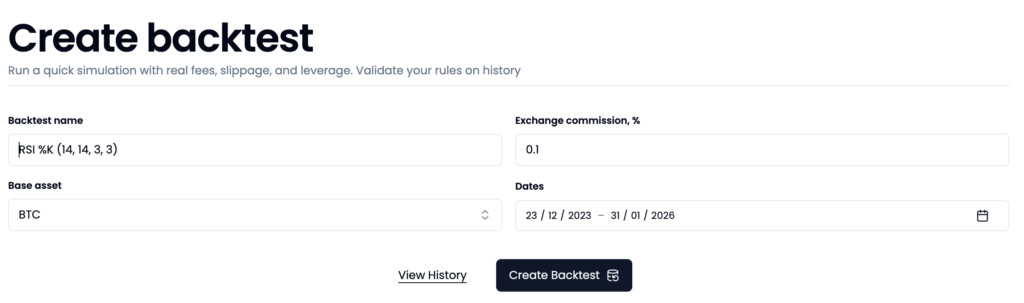

Backtesting: how to validate a strategy on historical data

A strategy backtest simulates your rules on historical data. It is not a promise of future returns. It is a way to observe how your system behaves across different market conditions.

When you backtest, realism is everything. Fees and slippage are not small details. For active strategies they can be the difference between a profitable curve and a flat line.

When reading a backtest report, avoid getting hypnotized by total return. Start with maximum drawdown. Then look at the number of trades. If there are too few, your conclusions are weaker. Then look at the equity curve. If profit comes from one short segment of history, treat that as a warning.

For experienced users, compare multiple versions of the same idea. Change one parameter at a time. This helps you learn what actually drives results.

Why backtests lie and how to reduce self-deception

The most common trap is overfitting. You tune indicator parameters until the past looks perfect. That often collapses in the future.

The second trap is testing without realistic fees and slippage. That is not “conservative”. It is simply not the market.

The third trap is using too short a history window. Crypto markets shift between trending phases, ranges, and high-volatility regimes.

A practical antidote is to split data into two parts. Use the first part to shape the idea, and the second part to validate it. For advanced users, a walk-forward approach is even better. You tune on one window, validate on the next, and keep moving forward.

Demo Exchange: your bridge from simulation to reality

After backtesting, the best next step is a Demo Exchange workflow. It is the bridge between historical simulation and real money. You see how the bot behaves in real time, you catch mismatches, and you adjust rules safely.

This phase often reveals practical issues. Signals can fire during high volatility and entries may fill worse than expected. Fees can differ from assumptions. The Demo Exchange step helps you catch that before you scale.

If you are new, keep a tiny log. Write down why the bot entered, why it exited, and what the chart looked like. This turns algorithmic trading from a black box into a system you can reason about.

Launching via exchange API: how to go live safely

When you switch to live mode, do it gradually.

Confirm your API key permissions are minimal. Reduce position size. Cap the number of active trades. Make sure Stop Loss is defined and behaves as expected. Then give the strategy time to run on small size. Early on, your job is to confirm that execution matches your intent.

If you trade multiple coins, watch for hidden correlation risk. Many assets move together when the market drops. It may look diversified, but the risk is often the same.

Advanced approach: building strategies that survive regime changes

If you are experienced, build strategies modularly. Market regime filter first, entry trigger second, position management third. This structure is easier to maintain and easier to test.

Avoid optimizing everything at once. First, make drawdown acceptable and logic explainable. Then improve efficiency. Keep your anti-overfitting checks in place: out-of-sample validation, walk-forward testing, Demo Exchange testing, and gradual live rollout.

FAQ

Can I build a crypto trading bot without coding

Yes. Strategy Builder lets you assemble trading rules from indicators and conditions without writing code. You still need to understand risk and logic.

What matters more: win rate or drawdown

For most traders, drawdown and stability matter more. High win rate can be misleading if losses are rarely cut.

Why can a profitable backtest fail in live trading

Because markets change and backtests look backward. Overfitting, fees, and slippage also play a major role. That is why out-of-sample validation and Demo Exchange testing matter.

How much should I start with

Start with an amount you can afford to lose. In the beginning, process and validation beat speed.

Bottom line

Building a no-code crypto trading bot is realistic when you treat it as a process. In Skyrexio, you can do it through Strategy Builder: build the strategy, backtest it, validate it on a Demo Exchange workflow, and then launch it via exchange API.

If you move step by step, you do not just get a bot. You get a repeatable system you can improve and scale.